Winning Strategies for CS:GO Enthusiasts

Explore the latest tips and tricks to elevate your CS:GO gameplay.

Tokenomics: The Game Changer You Didn't See Coming

Discover how tokenomics is revolutionizing the crypto landscape and changing the game—don't miss this essential guide!

Understanding Tokenomics: How It Shapes the Future of Decentralized Finance

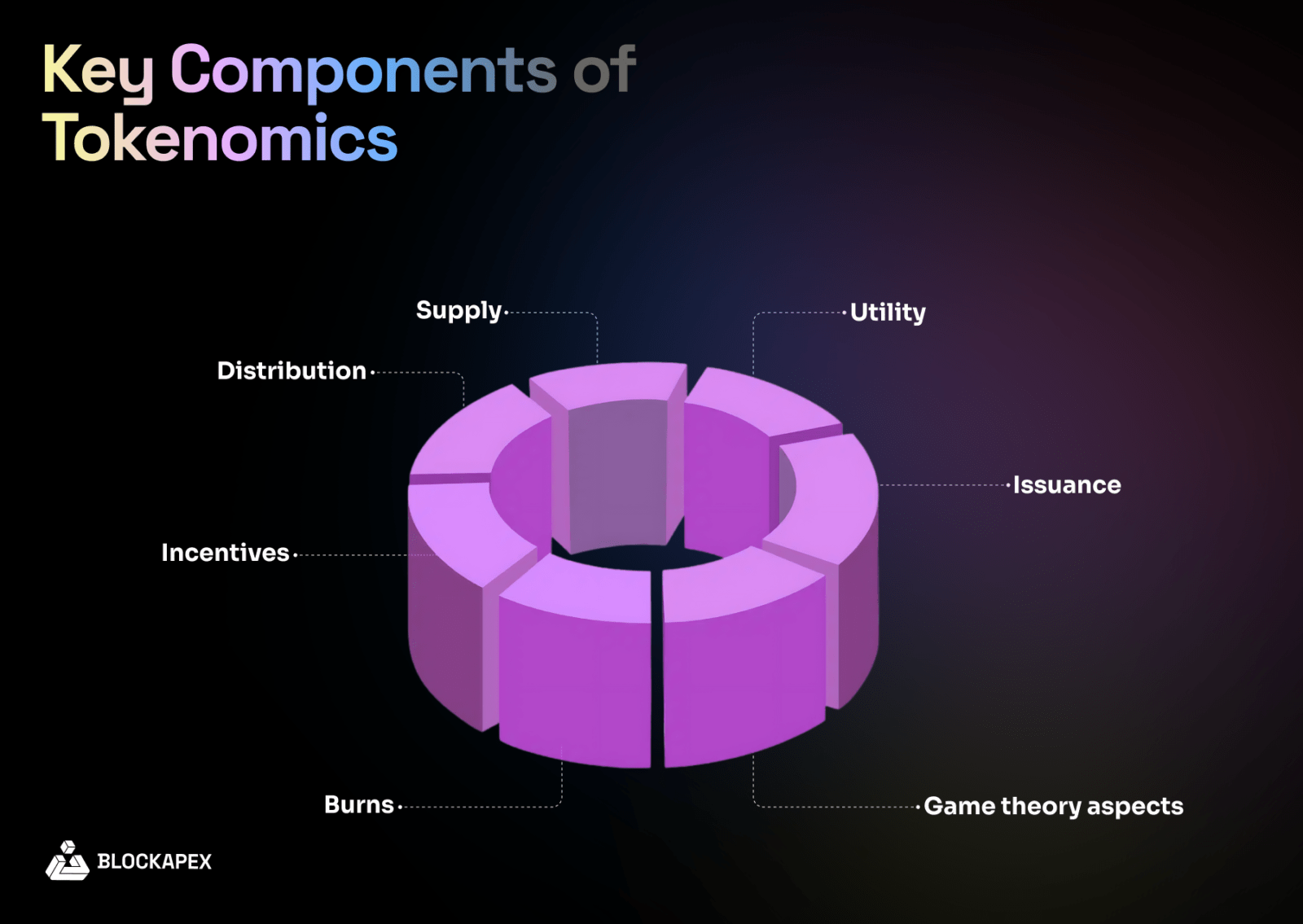

Tokenomics refers to the study and design of the economic systems surrounding cryptocurrency tokens, playing a crucial role in the world of Decentralized Finance (DeFi). It encompasses various elements such as token supply, distribution mechanisms, and utility within the ecosystem. An effective tokenomics model ensures that tokens have intrinsic value while also providing incentives that drive participation and investment. By understanding the dynamics of token economics, investors and users can make informed decisions, helping to foster sustainable growth and a thriving DeFi landscape.

One of the key components of tokenomics is the concept of utility tokens, which serve specific purposes within their respective platforms. Unlike traditional cryptocurrencies, these tokens often provide access to services, governance rights, or access to exclusive features. This functionality adds to their value proposition and encourages user engagement. Additionally, mechanisms like staking and liquidity mining incentivize users to hold onto their tokens, thus stabilizing their value and encouraging long-term investment. As the DeFi space continues to evolve, understanding the nuances of tokenomics will be vital for embracing its future potential.

Counter-Strike is a popular first-person shooter game that pits two teams against each other: the Terrorists and the Counter-Terrorists. Players can choose different weapons and strategies to achieve their objectives, such as planting or defusing bombs. For those looking for bonuses while enjoying their time in gaming, check out the bc.game promo code to enhance your experience.

The Impact of Tokenomics on Cryptocurrency Value: What You Should Know

Tokenomics refers to the study of the economics surrounding cryptocurrencies and their underlying tokens. It encompasses aspects such as supply, distribution, and incentives that drive demand. A well-structured tokenomics model can greatly influence the perceived value of a cryptocurrency. Key factors include the total supply of tokens, inflation rates, and the mechanisms for token burns or locks, which can create scarcity and impact investor sentiment. For instance, when a project implements a deflationary model, where tokens are periodically burned, it can lead to increased demand and a rise in value due to the principle of supply and demand.

Moreover, the utility of a token plays a critical role in its value proposition. Tokens that offer real-world applications, such as governance rights or access to specific services, tend to attract users and investors alike. Additionally, community engagement and the project's roadmap can significantly affect tokenomics. As investors perceive transparency and a clear direction, they are more likely to buy and hold the tokens. Therefore, understanding the intricacies of tokenomics is vital for anyone looking to invest in cryptocurrencies, as it can directly impact not just the present value but also the future potential of these digital assets.

Is Tokenomics the Key to Sustainable Blockchain Projects?

Tokenomics plays a critical role in shaping the viability of blockchain projects. It encompasses the economic models of cryptocurrencies, including how tokens are distributed, used, and incentivized within a network. A well-designed tokenomics framework fosters a balanced ecosystem where the interests of users, developers, and investors align. This alignment is essential for encouraging participation and long-term commitment. As such, tokenomics can be seen not just as a technical necessity but as a foundational element that drives the sustainability of blockchain ventures.

Moreover, effective tokenomics can mitigate common challenges faced by blockchain projects, such as market volatility and user engagement. By introducing mechanisms like staking, rewards, or governance voting, projects can create a sense of ownership and community among participants. Additionally, transparent and adaptive token designs help build trust and credibility, which are vital for attracting new users. In summary, tokenomics is indeed a key factor that can spell the difference between a thriving blockchain initiative and one that struggles to find its footing in the competitive landscape.