Winning Strategies for CS:GO Enthusiasts

Explore the latest tips and tricks to elevate your CS:GO gameplay.

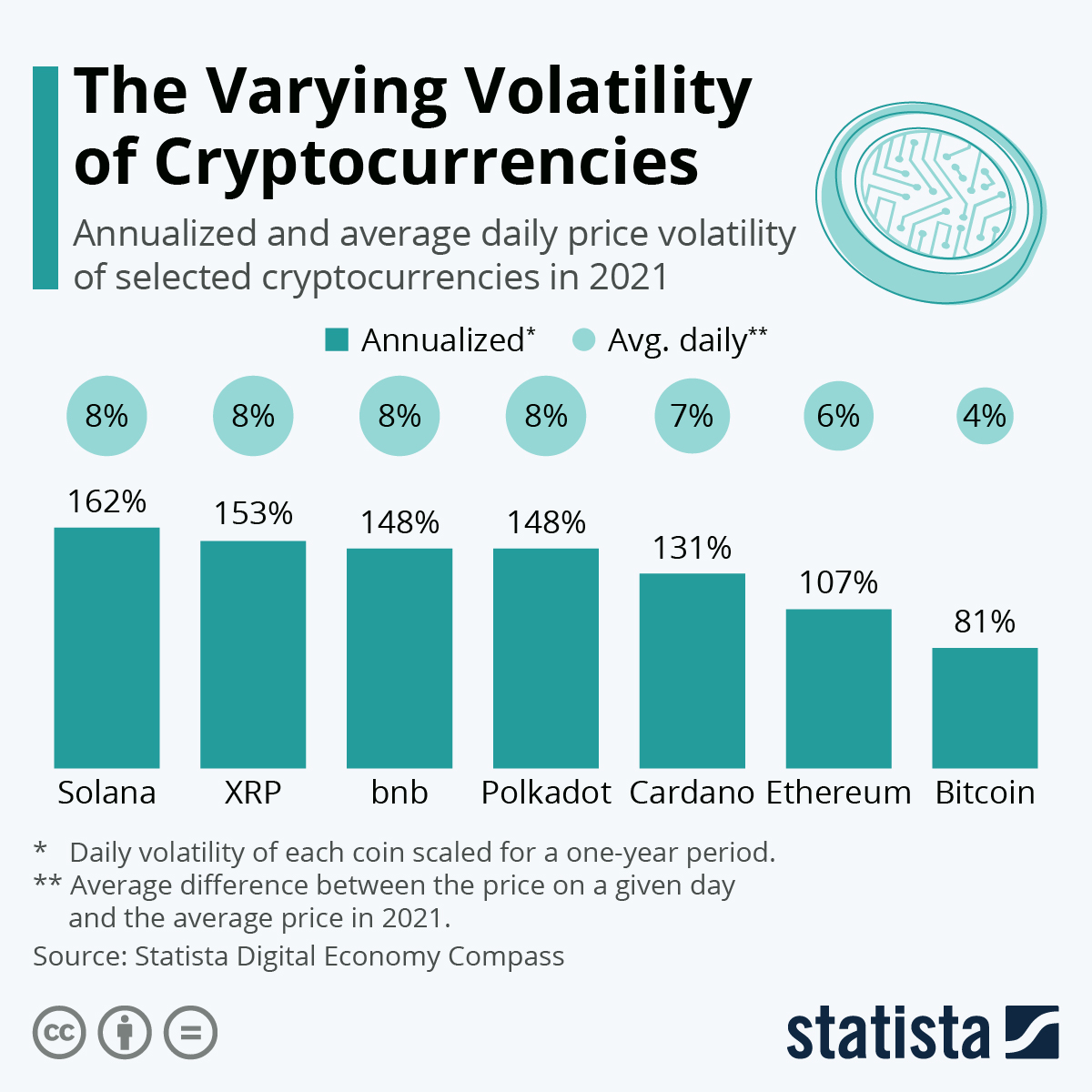

Crypto Market Volatility: Riding the Rollercoaster of Digital Assets

Dive into the wild world of crypto market volatility and discover how to navigate the thrilling ups and downs of digital assets!

Understanding Crypto Market Volatility: Key Factors That Drive Price Swings

Understanding crypto market volatility is crucial for investors aiming to navigate the unpredictable nature of digital currencies. Several key factors contribute to these price swings, including market sentiment, regulatory news, and technological developments. For instance, market sentiment can shift rapidly; positive news might trigger a buying frenzy, while negative developments can lead to panic selling. Additionally, regulatory news, such as government announcements or changes in laws, can have an immediate impact on prices. As the crypto market matures, these factors often become intertwined, further complicating the volatility landscape.

Another significant driver of market volatility is liquidity, which refers to the ease with which assets can be bought or sold without impacting their price. In the crypto market, liquidity can vary widely among different exchanges and coins. Low liquidity can exacerbate price swings, resulting in sharp movements for relatively small transactions. Furthermore, the overall market structure, including the presence of institutional investors and retail participation, plays a pivotal role in shaping these price dynamics. Understanding these elements is vital for anyone looking to make informed investment decisions in the fluctuating world of cryptocurrencies.

Counter-Strike is a popular multiplayer first-person shooter game that pits teams of terrorists against counter-terrorists in various gameplay modes. Players can choose to play in competitive matches or casual games, aiming to complete objectives such as bomb defusal or hostage rescue. For those interested in enhancing their gaming experience, check out the cloudbet promo code that offers exciting bonuses and rewards.

How to Strategically Invest in a Volatile Crypto Market

Investing in a volatile crypto market requires a well-thought-out strategy to maximize potential gains while minimizing risks. Understanding market fluctuations is crucial; cryptocurrencies can experience dramatic price swings in a short period, making it essential for investors to stay informed. One practical approach is to diversify your portfolio by investing in different coins. This not only spreads out risk but also allows you to capitalize on various market trends. Additionally, consider employing dollar-cost averaging, which involves investing a fixed amount at regular intervals regardless of the asset's price, helping to reduce the impact of volatility.

Another key strategy is conducting thorough research to identify projects with strong fundamentals and a good track record. Follow major influencers on social media and join crypto communities to gather insights and sentiment about the market. Setting clear investment goals and sticking to them can also help you navigate the ups and downs. It’s advisable to have an exit plan in place—deciding in advance when to take profits or cut losses can ensure you make informed decisions rather than emotional ones. In summary, a strategic approach to investing in a volatile crypto market involves diversification, research, and disciplined decision-making.

What Does Market Volatility Mean for the Future of Digital Assets?

Market volatility refers to the significant price fluctuations that occur in financial markets over a short period of time. When it comes to digital assets like cryptocurrencies, market volatility can be particularly pronounced due to factors such as speculative trading, regulatory changes, and technological advancements. As more investors and institutions turn their attention to digital assets, understanding the implications of market volatility becomes crucial. For instance, periods of high volatility can deter risk-averse investors, while also presenting opportunities for savvy traders to capitalize on price swings.

Looking to the future, the impact of market volatility on digital assets is likely to evolve. On one hand, increased institutional adoption may lead to greater market stability, as large players typically bring more liquidity and reduce price swings. On the other hand, as the digital asset ecosystem continues to mature with innovations like decentralized finance (DeFi) and non-fungible tokens (NFTs), we may see new forms of volatility emerge. Ultimately, navigating this landscape will require a robust strategy, keeping an eye on both short-term fluctuations and long-term trends to make informed investment decisions.