Winning Strategies for CS:GO Enthusiasts

Explore the latest tips and tricks to elevate your CS:GO gameplay.

Discounts You Didn't Know You Could Score on Auto Insurance

Unlock hidden savings! Discover surprising discounts on auto insurance that could save you hundreds. Start saving today!

Unlock Hidden Savings: 7 Auto Insurance Discounts You Might Be Missing

Many drivers are unaware that they might be leaving money on the table when it comes to their auto insurance policies. By unlocking hidden savings, you can enhance your financial well-being while ensuring you have the right coverage. 7 auto insurance discounts that you might be missing could significantly reduce your premiums. From safe driving rewards to bundling policies, incorporating these discounts into your insurance search can lead to substantial savings.

Here are some of the auto insurance discounts you might not know about:

- Multi-Policy Discount: Save by bundling your auto insurance with your home or renters insurance.

- Good Driver Discount: Enjoy savings for a clean driving record over a specified period.

- Low Mileage Discount: Drive less than the average driver and receive discounts for your limited mileage.

- Safety Features Discount: Equip your vehicle with safety features like anti-lock brakes and airbags for added savings.

- Student Discount: Young drivers with good grades may qualify for discounts.

- Military Discount: Many insurers offer special pricing for active and retired military personnel.

- Pay-in-Full Discount: Save money by paying your entire premium upfront.

Are You Paying Too Much? Discover Lesser-Known Auto Insurance Discounts

Are you aware that you might be overpaying for your auto insurance? Many drivers miss out on valuable savings because they are unaware of the various lesser-known auto insurance discounts available to them. For instance, many insurers offer discounts for good driving behavior. By maintaining a clean driving record, you not only ensure your safety but could also unlock various savings on your premiums. Additionally, bundling your auto insurance with other policies, like home or renters insurance, can lead to significant discounts. Always check with your provider about bundling options to maximize your savings.

Another hidden gem in the world of auto insurance discounts lies in the realm of affiliation discounts. Many companies provide lower rates for members of certain organizations, alumni associations, or even those who work for specific employers. To put it simply, your membership in a particular group could translate into real savings on your policy. Furthermore, don’t forget to ask about low mileage discounts. If you use your vehicle sparingly, your insurance provider may reward you with reduced rates, acknowledging the reduced risk of accidents. Inquire today to see if you're eligible for these and other discounts that might apply to you!

Maximize Your Savings: A Comprehensive Guide to Uncommon Auto Insurance Discounts

In the quest to maximize your savings on auto insurance, many drivers overlook some lesser-known discounts that can lead to significant savings. Companies often provide discounts for factors like low mileage, safe driving records, and bundling policies. However, it's essential to dig deeper to discover unique opportunities. For instance, did you know that some insurers offer discounts for participating in defensive driving courses or for being a member of certain professional organizations? Exploring these uncommon auto insurance discounts can substantially reduce your premium costs.

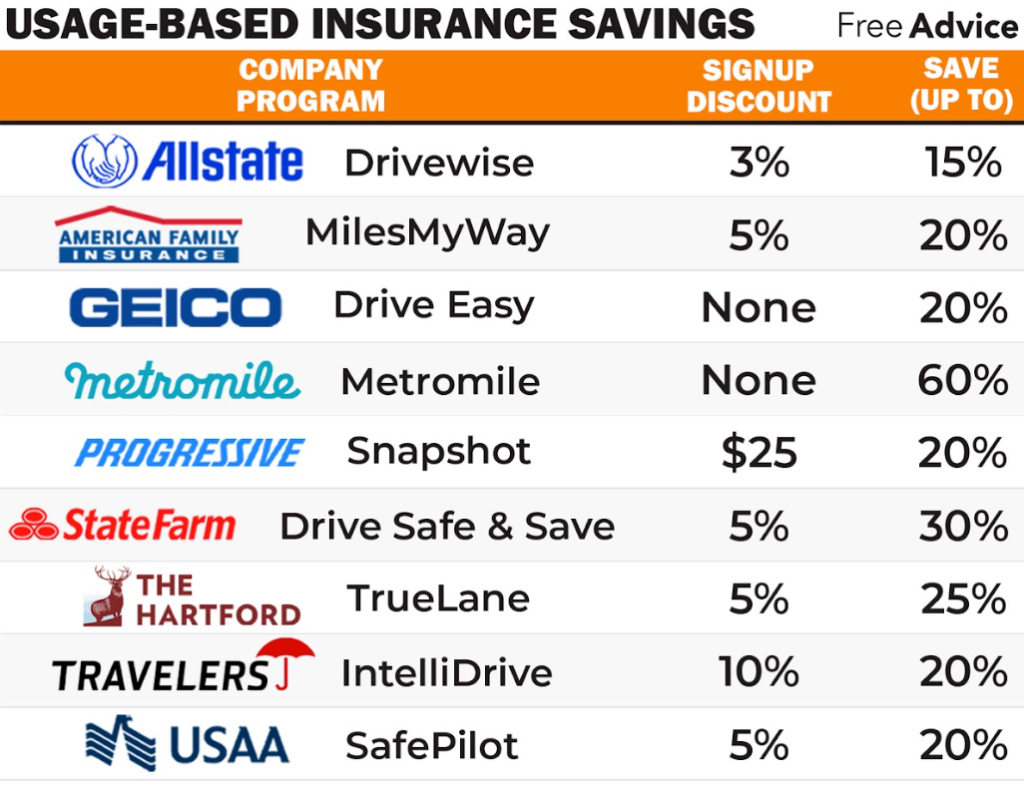

Another avenue for savings comes from technological advancements in the auto insurance industry. Many insurers now provide discounts for using telematics devices that track your driving behavior. By demonstrating safe driving habits, you may qualify for significant reductions on your premiums. Furthermore, discounts might be available for electric or hybrid vehicles, as insurers are increasingly incentivizing eco-friendly choices. Being proactive in seeking out and asking about these discounts can help you uncover savings you never knew existed, ensuring that you maximize your overall savings.