Winning Strategies for CS:GO Enthusiasts

Explore the latest tips and tricks to elevate your CS:GO gameplay.

Whole Life Insurance: The Safety Net Nobody Talks About

Discover the hidden benefits of whole life insurance and why it could be the safety net you never knew you needed!

Understanding Whole Life Insurance: Benefits Beyond the Premiums

Whole life insurance offers numerous benefits that extend far beyond the payment of premiums. One key advantage is the cash value accumulation, which allows policyholders to build savings over time. This cash value grows at a guaranteed rate, providing a reliable source of funds that can be accessed through loans or withdrawals. Additionally, the death benefit associated with whole life insurance ensures that beneficiaries are financially protected, offering peace of mind for the policyholder. This dual benefit of savings and protection makes whole life insurance a compelling choice for those looking to secure their financial future.

Another significant benefit of whole life insurance is its fixed premiums that remain constant throughout the life of the policy. This stability is advantageous for long-term financial planning, as it helps individuals budget effectively without worrying about fluctuating costs. Furthermore, whole life insurance policies often participate in dividends, which can be reinvested to further increase the cash value or used to reduce premiums. Overall, understanding the multifaceted advantages of whole life insurance can help individuals make informed decisions about their financial security and legacy.

Whole Life Insurance vs. Term Life: Which Safety Net is Right for You?

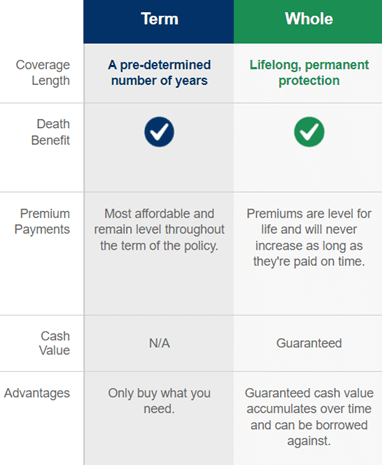

When choosing between Whole Life Insurance and Term Life Insurance, it’s essential to understand the fundamental differences and implications of each option. Whole life insurance provides coverage for the policyholder's entire life, as long as premiums are paid. This type of insurance also builds cash value over time, which can be borrowed against or withdrawn if necessary. In contrast, term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years, and does not accumulate cash value. The main appeal of term life insurance lies in its affordability, making it an attractive option for those seeking insurance primarily for a particular phase of life, such as raising children or paying off a mortgage.

Ultimately, the decision between Whole Life Insurance and Term Life Insurance should align with your financial goals and family needs. Whole life insurance may be more suitable for individuals looking to establish a permanent safety net that also serves as a long-term investment strategy. On the other hand, if you need a cost-effective solution that covers you during critical years, term life insurance can provide the necessary protection without the higher premium costs associated with whole life policies. Assess your current life situation, future financial obligations, and personal preferences to determine which type of policy serves as the best safety net for you.

5 Common Myths About Whole Life Insurance Debunked

Whole life insurance is often surrounded by misconceptions that can lead potential policyholders down the wrong path. One common myth is that whole life insurance is too expensive compared to term life insurance. While it is true that whole life policies generally come with higher premiums, they also provide lifelong coverage and accumulate cash value over time. This means that although you may pay more initially, the long-term benefits and security can outweigh the costs.

Another prevalent myth is that whole life insurance is only beneficial for the wealthy. In reality, individuals from various financial backgrounds can find value in whole life policies due to their ability to provide guaranteed coverage and a savings component. In fact, the cash value can be accessed in times of financial need, making it a versatile option for many families. It's crucial to evaluate your personal circumstances before dismissing whole life insurance based on these misconceptions.