Winning Strategies for CS:GO Enthusiasts

Explore the latest tips and tricks to elevate your CS:GO gameplay.

Don't Let Bad Luck Ruin Your Trip: Why Travel Insurance is a Must

Protect your adventures! Discover why travel insurance is essential to ensure bad luck doesn't derail your dream trip. Don't risk it!

Top 5 Reasons Why Travel Insurance is Essential for Every Trip

Travel insurance is a critical component of any trip, offering peace of mind against unexpected events. Here are the top 5 reasons why travel insurance is essential:

- Unexpected Medical Expenses: One of the primary reasons to invest in travel insurance is to cover medical emergencies that may arise while you are away from home. Health care costs can be exorbitant, especially in foreign countries.

- Trip Cancellations: If you need to cancel your trip due to unforeseen circumstances, such as illness or emergencies, travel insurance can reimburse you for non-refundable costs.

- Lost or Delayed Luggage: Travel insurance can provide coverage for lost or delayed baggage, allowing you to replace essential items and continue with your trip without major disruptions.

- Travel Delays: Insured travelers can claim compensation for unexpected delays that may affect their itinerary, helping to alleviate some of the financial burdens associated with travel disruptions.

- Comprehensive Coverage: Many policies offer a range of protections, including coverage for missed connections and travel accidents, ensuring that you are safeguarded from various travel-related uncertainties.

What Does Travel Insurance Actually Cover? Your Questions Answered

Travel insurance is designed to protect you from unexpected events that could disrupt your travel plans. While specific coverage can vary by policy, most travel insurance plans generally cover a range of issues including trip cancellations, medical emergencies, and lost luggage. For instance, if you need to cancel your trip due to unforeseen circumstances such as illness or a family emergency, your policy can reimburse you for non-refundable expenses.

Another critical area that travel insurance typically covers is emergency medical expenses. If you fall ill or sustain an injury while traveling, having travel insurance can ensure you receive the necessary medical attention without incurring exorbitant out-of-pocket costs. Additionally, many policies provide coverage for travel delays or interruptions, meaning that if your flight is cancelled or your luggage is lost, you may be eligible for compensation. Always read the fine print to understand the extent of your coverage and any exclusions that may apply.

How to Choose the Right Travel Insurance for Your Adventure

Choosing the right travel insurance for your adventure can be crucial for a worry-free experience. Start by assessing your needs based on the type of trip you’re taking. Consider factors such as your destination, the duration of your stay, and the activities you will be doing. For instance, if you’re planning a hiking trip in the mountains, you may require a policy that covers high-risk activities. Furthermore, look for financial protection against unforeseen circumstances such as trip cancellations, lost baggage, or medical emergencies. Make a list of essential features to compare different policies effectively.

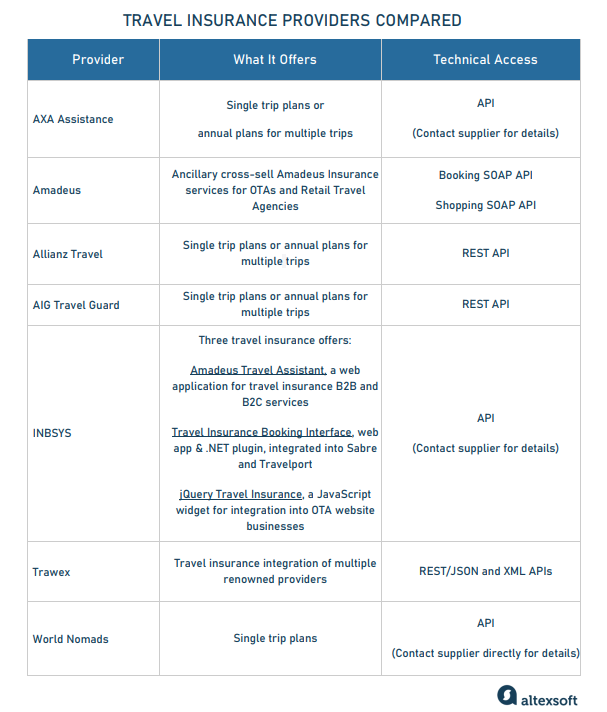

Next, pay attention to the specific details of the travel insurance policy. It’s important to understand what is included and excluded to avoid unpleasant surprises. Read through the fine print and look for coverage limits, deductibles, and any pre-existing conditions that might be relevant to your situation. Additionally, consider customer reviews and the reputation of the insurance provider. A company known for its reliable service can give you peace of mind during your travels. By taking the time to research and choose the right plan, you can ensure a safer, more enjoyable adventure.