Winning Strategies for CS:GO Enthusiasts

Explore the latest tips and tricks to elevate your CS:GO gameplay.

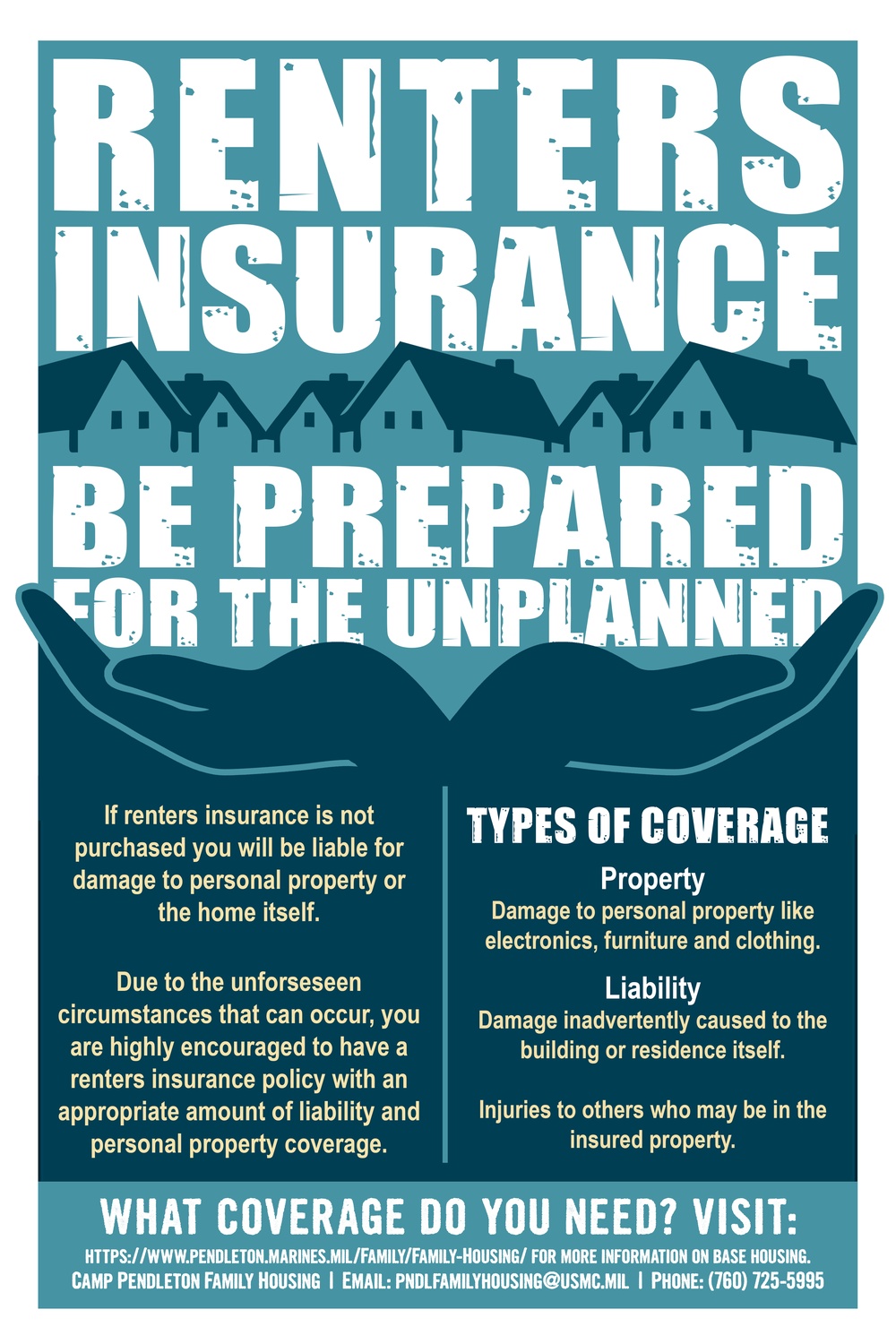

Why Renters Insurance is Like an Umbrella for Your Belongings

Discover why renters insurance is your ultimate shield against loss and damage—keep your belongings safe with this must-read guide!

How Renters Insurance Protects Your Valuables: A Comprehensive Guide

Renters insurance is an essential safeguard for anyone who rents their home. It offers a layer of protection that goes beyond mere shelter, ensuring that your valuables are covered in the event of damage or theft. This type of insurance typically covers personal property such as furniture, electronics, clothing, and even valuable items like jewelry. In addition to protecting your belongings from common risks like fire, vandalism, or theft, renters insurance also provides liability coverage that can assist you if someone is injured in your rental property. Overall, renters insurance acts as peace of mind for those who want to protect their personal assets.

When considering how renters insurance works, it's helpful to understand the specific types of coverage available. Policies commonly feature the following:

- Personal Property Coverage: This covers your personal belongings against theft or damage.

- Liability Protection: This helps cover medical expenses or legal fees if someone is injured in your rental.

- Additional Living Expenses: Should your rental become uninhabitable due to a covered peril, this provides financial assistance for temporary housing.

Understanding these components can help you tailor your renters insurance policy to fit your specific needs, ensuring comprehensive protection for your valuable assets.

Is Renters Insurance Worth It? Understanding the Benefits of an Umbrella for Your Possessions

When it comes to protecting your possessions, the question of Is Renters Insurance Worth It? often arises. Renters insurance serves as a safety net for tenants, covering losses due to theft, fire, or even natural disasters. Many renters mistakenly believe that their landlord's insurance will cover their personal items; however, this is not the case. Without renters insurance, individuals risk facing significant out-of-pocket expenses in the event of an unfortunate incident, making it a crucial component of financial security for those who rent their homes.

Moreover, opting for renters insurance can provide the added benefit of an umbrella policy, which extends coverage beyond just personal belongings. An umbrella insurance policy offers liability protection, ensuring that you're safeguarded against lawsuits or damages that may arise from accidents that occur on your rental property. In a world where unexpected events can lead to financial turmoil, having this layer of protection can give renters invaluable peace of mind and enhance their overall sense of security.

What Does Renters Insurance Cover? A Deep Dive into Your Safety Net

Renters insurance is designed to protect your personal belongings and provide liability coverage for unforeseen events. Typically, this insurance covers personal property, which includes items such as furniture, electronics, and clothing, in the event of theft, fire, or vandalism. Additionally, many policies offer personal liability coverage, which helps pay for legal fees and medical expenses if someone is injured in your rented space. It's essential to closely examine your policy to understand the specific coverage limits and exclusions that may apply.

Moreover, renters insurance often includes coverage for additional living expenses (ALE) should you be forced to temporarily relocate while your rental unit is being repaired due to a covered loss. This can help cover costs such as hotel stays and meals, ensuring that you are not left financially vulnerable during difficult times. Many renters underestimate the importance of this safety net, but having the right protection in place can make all the difference in maintaining your peace of mind. Remember, having renters insurance is not just a smart financial decision; it’s an essential part of creating a secure living environment.